Stephen J.

Dann

In the past eighteen years I have obtained tax refunds of ThB 401,742,611 from the Revenue Department of Thailand for 1065 teachers of various nationalities including Australian, American, British, and Canadian using the tax exemption granted in many tax treaties, and am the author of this article on the Ajarn.com website for teachers in Thailand:

If you lived in the UK before teaching in Thailand, your original school contract was for no more than two years (regardless of the subject),

and that initial school contract covered any of the years 2023, 2024, or 2025 you are probably entitled to

claim of all your Thai income tax back by virtue of the Double Taxation Agreement between Thailand and the UK.

Many countries have such agreements, but eligibility to claim depends upon where you were resident prior to working at a school in Thailand, not upon your nationality. The UK agreement, for example, exempts individuals of any nationality who were resident in the UK before commencing their first teaching contract at a school in Thailand. The teacher does not need to be British, but to have been a UK resident. The UK agreement only exempts British nationals if they were resident in the UK immediately before visiting Thailand to teach, and any British nationals who were living in other countries should refer to the agreements with those other countries.

If you are uncertain as to whether you are eligible to claim your tax back please contact me using the email facility on this page for an appraisal.

In order that I may review your situation I shall simply require a copy of your school contract and answers to some simple questions.

Where tax refunds are possible we can prepare and submit claims on your behalf, and the tax refunds will be wired direct to your bank account overseas once we receive your tax reimbursement from the Revenue Department.

With the consent of all concerned, I am prepared to conduct shared meetings with groups of teachers which saves me repeating the same information to each individual, and which also benefits everyone at the meeting through listening to colleagues' questions and reactions. As a result everyone becomes more knowledgeable about the process.

Determining whether someone is eligible to claim a tax refund is only part of the process, and as with many aspects of life it is not what you do that determines whether a claim is successful, but the way that you do it. Anyone who thinks they are simply going to hand a form in to the Revenue Department and receive a cheque with ease will be very disappointed. There is considerable prejudice directed against these claims and in some instances school administrators will collaborate with Revenue Department officers in order to mislead and confuse teachers so as to prevent them from claiming a tax repayment.

School Directors, often concerned to retain staff, sometimes dissuade teachers from filing a claim by maintaining they will have to pay tax in their home country if they claim a tax refund from Thailand. The teachers' tax exemption is contained within Double Taxation Agreements for a very good reason since "residence" is clearly defined by the terms of each treaty and this usually differs from the definition of "residence" in domestic legislation. This therefore means that a teacher may be entitled to claim a tax treaty refund by combining Articles 4 and 21 of the UK treaty, but may also be considered to be a UK resident under the Statutory Residence Test which applies different criteria in determining "residence". In this situation teachers would be creating a substantial UK tax liability for themselves by claiming a tax treaty refund.

I have my own Thai company (

Siam International Accounting Management Ltd.) and in order to assist with routine issues such as completion of forms in Thai, interpretation at meetings, and predictable day-to-day business I employ excellent Thai staff and use very precise technical translation facilities. My own role is primarily that of direct contact with the client and resolution of strategic issues such as challenging the Revenue Department's interpretation of legislation. We are the premier company in this field, operating now in "blue ocean" having left the sharks, amateurs and scammers fighting over the scraps left in very deep red sea of their own making. Every year there are additions to our service which extend the distance between us and the competition. If you are considering a rival company, try to establish how many staff they have who are experienced in this work, and what happens if they leave. Will they respond to emails in English after you have left Thailand? I even have one British "competitor" who works without a work permit and rents her "office" by the hour, constantly evading the Immigration Department to avoid deportation. If you think hiring a professional is expensive just wait until you discover how amateurs are saving on costs.

If I consider that a successful double taxation treaty claim is possible, the fee will be agreed in advance, and will depend upon the dates you worked, the school involved and the availability of documents. I usually request payment of ThB 20,000 plus Thai VAT (currently ThB 1,400) before commencing a claim, and then for payment of any balance of fees once the refund cheque has arrived.

Tax refund claims submitted now should take between three months and, exceptionally, two years from filing with the Revenue Department to the date of payment.

During this time you may view general notices about the progress of your tax refund via my Facebook page where you will find many teachers linked to me and you will promptly realise this is not a scam. In the age of Facebook, Wikileaks, and Twitter companies are better off telling people the truth which, in turn, respects employees' need to know what is really going on so that they can do their jobs. My staff are connected to the company Facebook page.

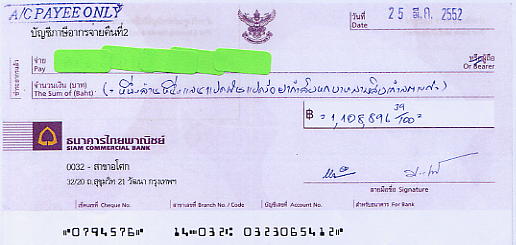

A successful claim (click image to enlarge)

Claims will not be accepted for the 2023 year after 31st October, 2026 since this presents insufficient time to prepare and submit documentation.

~ ITPA ~

UK Tax Advisor

Thailand/UK Double Tax Agreement - Teachers' Tax Exemption

Click here for Other Pages on this

Website

FOR TEACHERS LIVING IN THAILAND AND WORLDWIDE

It should be noted that I am a specialist tax advisor, and I do not involve myself in other kinds of work; I do not need to. A number of visa lawyers have attempted to process claims without fully appreciating the implications, or the manner in which tax treaty claims in Thailand interact with the tax system of other countries. It would be fair to say that people who hand something as complex as an international tax treaty claim to a mediocre firm of Thai lawyers are unlikely to receive any tax reimbursement, whereas a specialist team will make it work. We have become attuned to signs that a school isn't honouring its commitments, or that tax department officials are putting up too many obstacles, and we have established methods of handling these situations. Visa lawyers are merely looking for "easy" business by providing a minimal acceptable standard of service and attempting to attract clients with lower fees, resulting in a race to the bottom which leaves no margin for resolving the obstacles which frequently arise. Tax refunds are dependent upon highly ambiguous factors, such as the definition of a "visit" or "residence", and getting to the right answer can often involve some tough negotiations. My philosophy is best described as "better before cheaper" and it would serve their interests better if other companies concentrated on improving their performance in their core business, rather than looking for easy money from something they don't understand.

View testimonials and join my advice network on Linkedin:

![]()

![]()

.

When you have a copy of your contract to hand please send it to me using the email facility below,

..........................................................................................